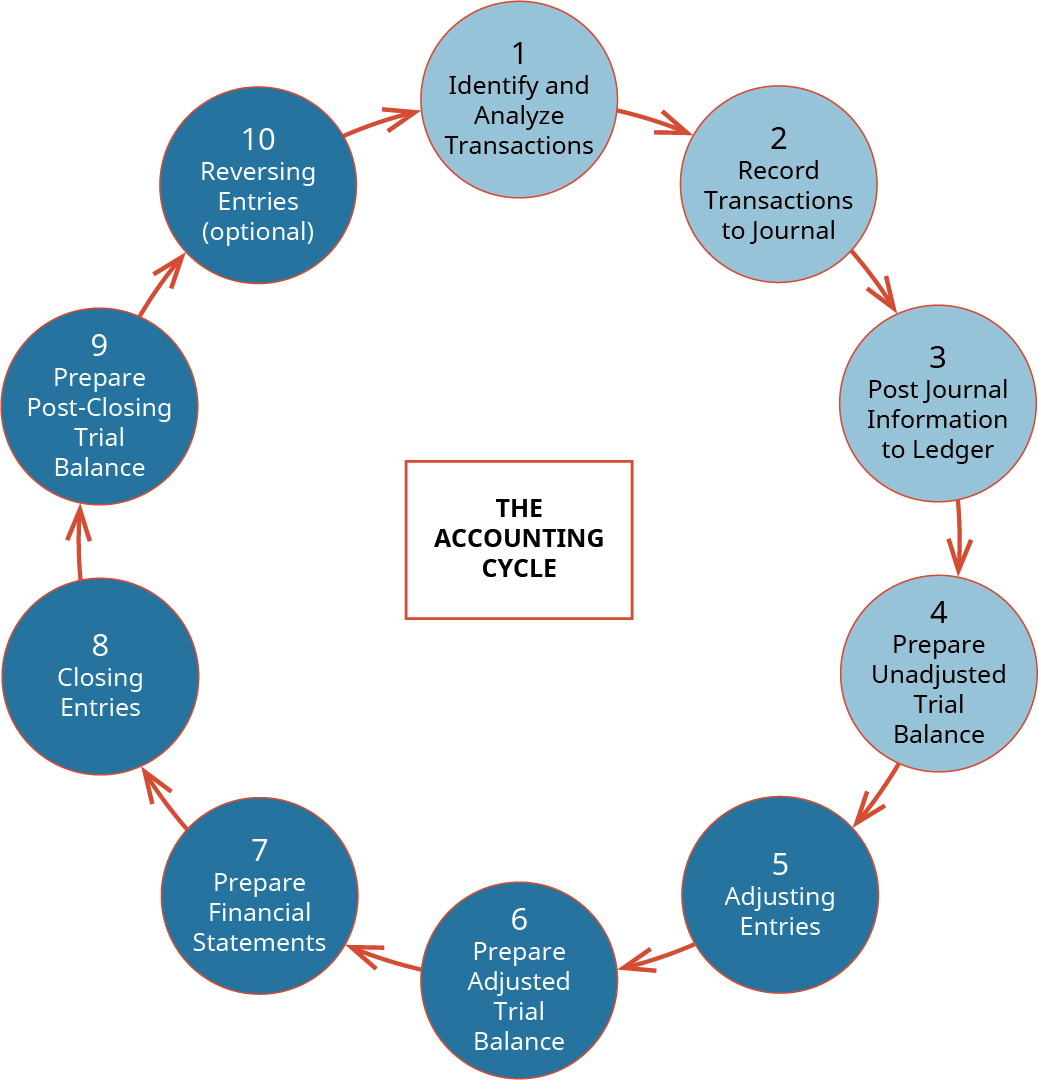

Generally accepted accounting principles or GAAP pronounced gap for short are. The six major steps of the accounting process are analyzing recording classifying summarizing reporting and interpreting.

Describe Principles Assumptions And Concepts Of Accounting And Their Relationship To Financial Statements Principles Of Accounting Volume 1 Financial Accounting

Describe the accounting process.

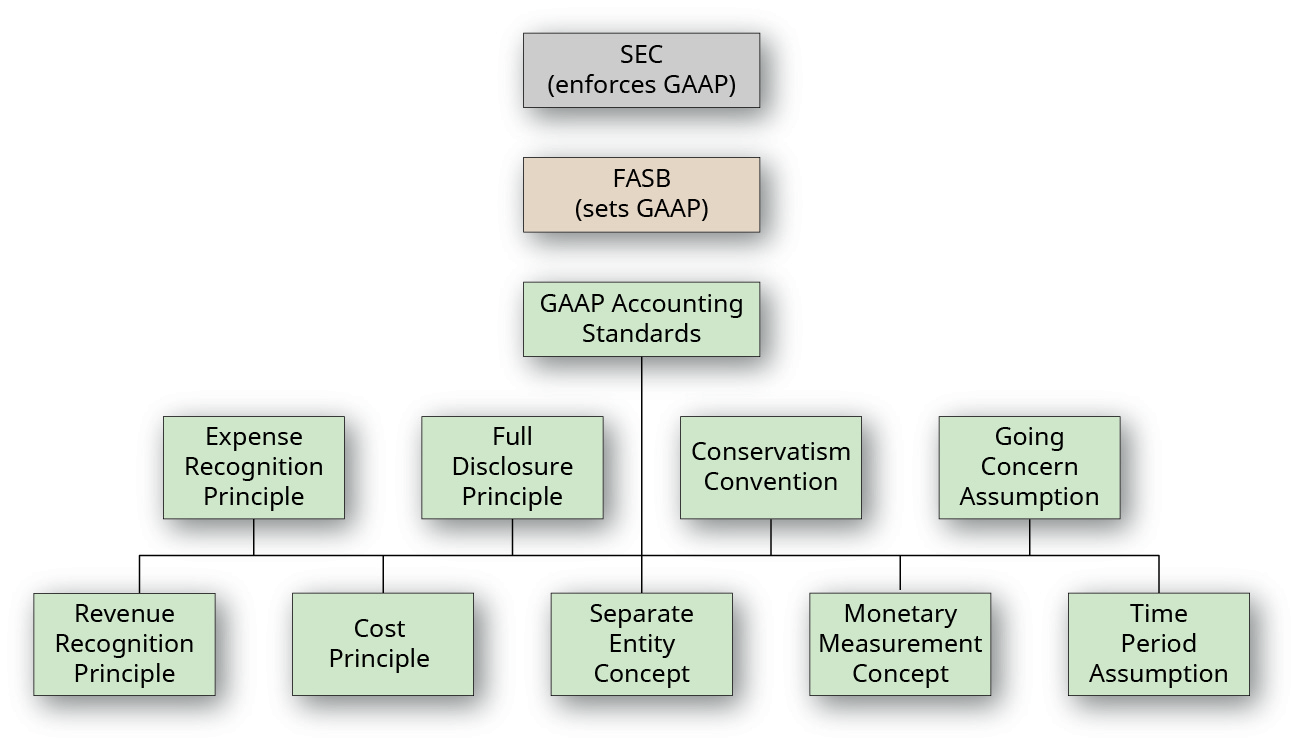

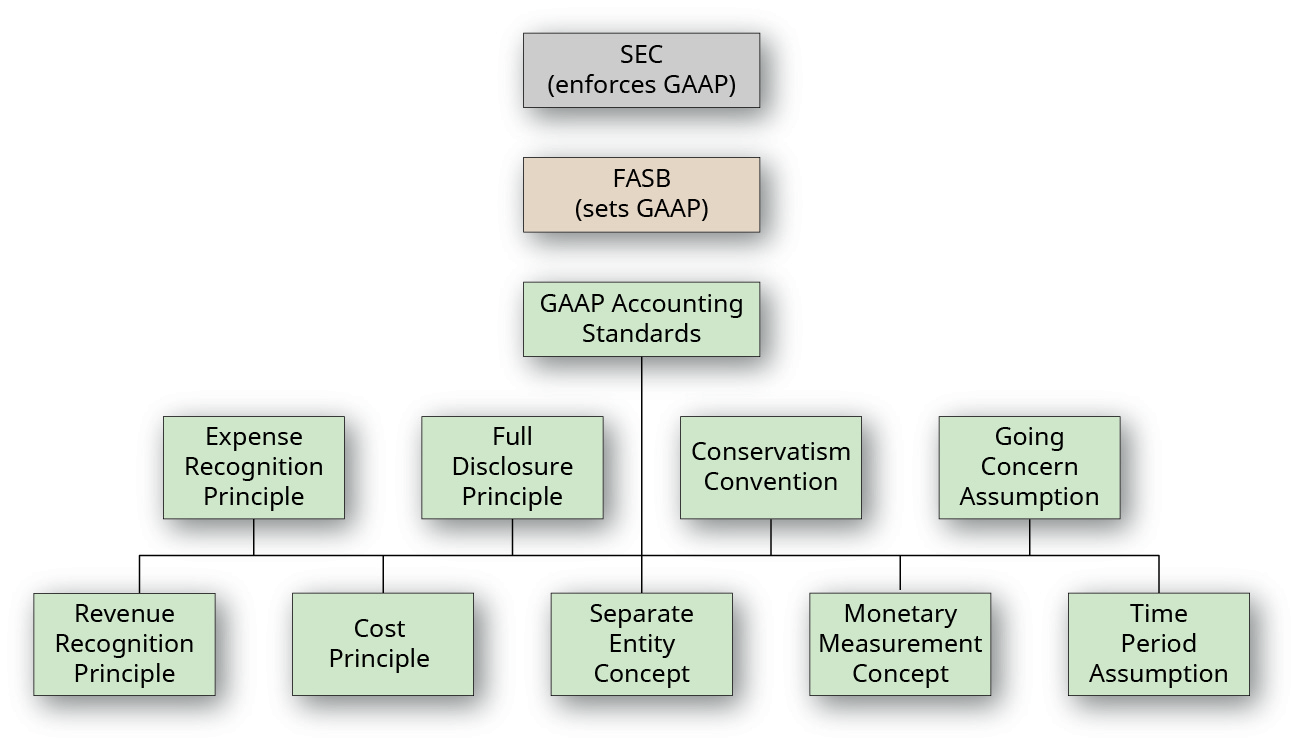

. The application of Generally Accepted Accounting Principles in the accounting process mirrors the absolute financial position of the company. Generally accepted accounting GAAP are the rules that businesses must follow when preparing financial. The process of developing GAAP include.

10 Basic Tenets of Generally Accepted Accounting Principles. Generally Accepted Accounting Principles or GAAP are a set of ten standards for all accounting and financial reporting practice in the United States. Two laws the Securities Act of 1933 and the Securities Exchange Act of.

Some use the term politicization in a narrow sense to mean the influence by governmental agencies predominantly the Securities and Exchange Commission on the development of generally accepted accounting principles. The standardization helps shareholders investors and creditors Creditors A creditor refers to a party involving an individual institution or the government that extends credit or lends goods property. Generally Accepted Accounting Principles GAAP or US GAAP are a collection of commonly-followed accounting rules and standards for financial reporting.

Generally Accepted Accounting Principles. In short generally accepted accounting principles GAAP are a set of commonly followed accounting standards and rules for financial reporting. An organizations transactions should remain separate from any transactions of other organizations or business owners.

The 10 generally accepted accounting principles include the following. Generally accepted accounting principles US. The standards include definitions concepts principles and industry-specific rules.

Principle of permanent methods. Here is a list of our partners and heres how we make money. The business is considered a separate entity so its activities must be kept separate from its business owners financial activities.

Others use it more broadly to mean the compromise that results when the groups responsible for developing generally. Accountants should apply the same rules consistently throughout all financial reporting and across all time periods. GAAP is constantly evolving as accountants seek better methods of providing.

March 28 2019. This chapter will introduce the agencies responsible for standardizing the accounting principles that are used in the United States and it will describe. The PCC also serves as the primary advisory body to the FASB on the appropriate.

Also there should be a consensus on how to apply them. The best way to understand the GAAP requirements is to look at the ten principles of accounting. GAAP is set forth in 10 primary principles as follows.

Securities and Exchange Commission SEC include definitions of concepts and principles as well as industry-specific rules. This principle ensures that consistent standards are followed in financial reporting from period to period. Accountants should follow GAAP rules.

GAAP comprises a broad set of principles that have been developed by the accounting profession and the Securities and Exchange Commission SEC. The specifications of GAAP which is the standard adopted by the US. Explain the process of creating GAAP.

In the US it has been established by the Financial Accounting Standards Board FASB and the American Institute of Certified Public Accountants AICPA. The PCC is responsible for determining whether and when to develop modifications to GAAP for private companies. In the United States this structure is created by US.

Here are the assumptions and principles of GAAP. The main criterion that can be used to distinguish between Generally accepted and non-accepted accounting principles is that the accepted ones have the official endorsement of the authorities responsible for regulating and developing the profession. Define GAAP and describe the process used by FASB to develop these principles.

It is important to note that this definition is quite broad taking in more than just the specific rules issued by standard setters. FASB members issue a discussion memorandum FASB collects all responses and suggestions from Securities and Exchange Commission SEC the American Institute of Certified Public Accountants AICPA. The Generally Accepted Accounting Principles GAAP are a set of rules guidelines and principles companies of all sizes and across industries in the US.

By DeVry University. The Financial Accounting Standards Board FASB develops the Generally Accepted Accounting Principles GAAP. These rules are set by the Financial Accounting Standards Board FASB and American Institute of Certified Public Accountants AICPA in order to ensure.

- Principle of Regularity- Principle of Consistency- Principle of Sincerity- Principle of Permanence of Method- Principle of Non-Compensation- Principle of Prudence- Principle of Continuity- Principle of Periodicity- Principle of Full Disclosure- Principle of Utmost Good Faith. While FASB is a private organization federal state and. These standards are described and set by the Financial Accounting Standards Board FASB an independent nonprofit organization.

In other words GAAP is a collection of concepts and best accounting practices accepted throughout the industry. Generally accepted accounting principles or GAAP encompass the rules practices and procedures that define the proper execution of accounting. Accountants use generally accepted accounting principles GAAP to guide them in recording and reporting financial information.

This is called the economic entity principle and it helps prevent inter-organizational mingling of liabilities and assets which is important during audits. It encompasses the long-standing methodologies and assumptions that. Closely related to the previous principle is that of consistent procedures and practices being applied in accounting and.

Economy since the end of the Great Depression. The availability of these authoritative guidelines has played a central role in the growth of the US. GAAP is built atop a set of core financial accounting principles and assumptions.

Generally Accepted Accounting Principles more widely known as GAAP are a set of guidelines and rules that all companies and accountants in the United States adhere to. It is important that you understand the concepts of Generally Accepted Accounting Principles GAAP which form the basis of accounting and are part of the language of accounting and business.

Generally Accepted Accounting Principles Gaap The Strategic Cfo

Define And Describe The Initial Steps In The Accounting Cycle Principles Of Accounting Volume 1 Financial Accounting

0 Comments